Somehow the previous owners of my home got themselves on a sucker list and regularly get mail from people trying to recruit them into various disreputable money-making schemes. I present one here for your edification.

(Links to full-resolution images are included below each picture.)

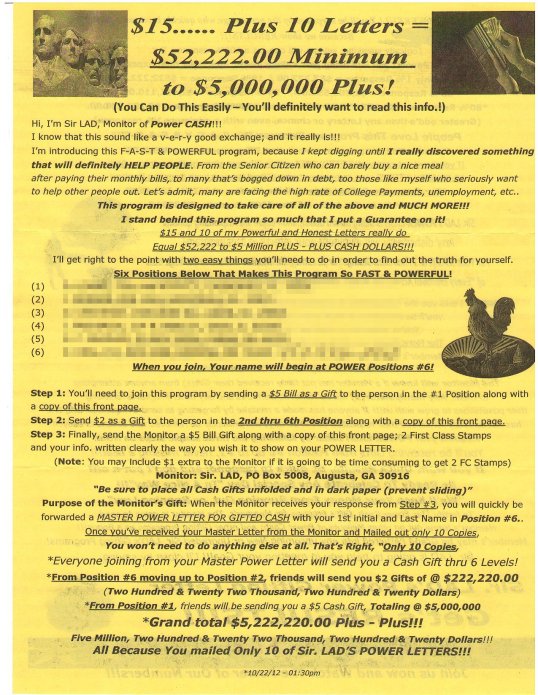

(I’ve redacted the names of people on the list, because unlike “Sir Lad,” the owner and operator of this Ponzi scheme, they are victims whether they know it or not.)

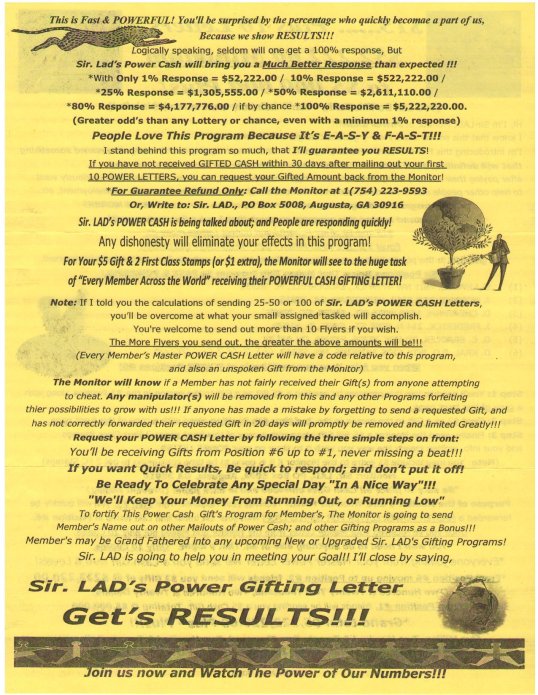

There’s not much to say about scams of this nature other than do the math, and you’ll see that any such program is unsustainable and depends on a constant influx of new victims and an unsupportable number of people at the bottom. Once again, the success of Sir Lad – the person at the top – is predicated on the failure of thousands of people at the bottom. It’s interesting to note that he has added an additional layer of profit to this scheme – even though he’s no longer on the list of “gift recipients,” as the “monitor” he skims $5.00 or $6.00 from every victim. Notice how the wording of the letter targets the elderly and people in economic distress, those who can least afford to lose what precious resources they have.

I have taken a sample section from an excellent educational website entitled Cash Gifting Watchdog – I recommend this as a must-read for people who want to protect themselves and their loved ones from losing their money to disreputable con-men.

Why do cash gifting programs eventually fail?

If members fail at marketing the programs to an ever-widening base of new members, then the pool of money being “gifted” among the existing members will dry up.

Cash gifting clubs promote themselves at invitation only gatherings similar to Tupperware parties, except that no product is being sold.

All those invited are there because an existing member of the program thinks they have money available to participate and will risk giving it to a complete stranger for the chance to have several complete strangers the same amount of money to them, multiplying their money (again, it’s never called an “investment”).

The “presenters” at cash gifting program gatherings give chalkboard or Power Point presentations which invariably end up with an image of a pyramid, showing how each member will make his or her way from the base to the top, where they will get the big payoff.

The money contributed by an incoming member goes to the top of the pyramid immediately, while the penniless member sits at the base of the pyramid until enough other members join to completely pay off the member at the top and move everyone else up a notch. Once a member is paid off, he or she is free to move on, but for a club to keep working, the money given to that member will have to be replaced from somewhere.

If, for example, the promised payout of a cash gifting club is $20,000, and the gift required is $2,500, only eight new members must be recruited to pay off one old member.

But what happens when a club reaches 100 members? If each of them is to get the full $20,000, for a total of $2,000,000, then 800 people must join. If each of them is to be paid, 6,400 must join. With each new level, the numbers grow more unrealistic.

For this example club, with its relatively low gifting and payout levels of $2,500 and $20,000, to continue for only two cycles after it gets its 100th member, 51,200 members must join.

Many clubs count on their paid off members to keep returning. Even if they all do, it is mathematically impossible for a cash gifting club to survive without an exponentially increasing membership base.

When the pool of new members dries up, so do the cash gifts, and any members who joined too late are out of luck – not to mention money.

Please be alert and aware. Programs like this are doomed to failure for all but those who begin them or happen to be the fortunate one or two at the very top of a new scheme. They are also dishonest, mean, and illegal in the extreme, but skirt the law by various means and tactics and thus are very hard to shut down.

Protect yourselves and your loved ones, particularly the elderly who are the most susceptible to such cons [1]

The Old Wolf has spoken.

Notes

[1] This is a bilingual pun, if you happen to speak French.